GrowthSource

Digital Loan Origination System (LOS)

GrowthSource is a leading digital-only NBFC was looking to build a platform to provide SMEs with secured and unsecured loans, loans against property, and personal and consumer durable loans.

Location – India

Technologies Used:

Backend – Java

Front End – ReactJS

Database – MS SQL 2016

Mobile App – React Native

Server – AWS

Executive Summary :

The primary purpose was with the Digital LOS was to design and execute a system to lend nimbler, standardized, streamlined and transparent loans to businesses and opening up new avenues for growth and profits. It was also required to manage the entire loan lifecycle from inquiry to data preparation for disbursement on a single, intelligent and highly advanced platform.

Challenges:

The primary hurdles included the following:

- Building a platform that can be used by sales, DSA’s, DST’s, etc.

Integrating fintech APIs for automated data population for seamless processing. - Building the credit underwriting module with rule engine integrations from CRIF.

- Creating a customer servicing and collection application.

- Developing a complete login management system to manage hierarchy within sales, credit, collection etc.

- Smooth and multi-threaded workflow from lead generation in sales to extensive credit decision-making phase and disbursement.

Solutions:

Focusing on the problem statement, the system was built using hybrid technology to make it available on both app and web. The entire application was leveraged microservices architecture to make it scale ready. The features that we developed included:

- A sourcing system that provides a similar user experience for all partners such as sales, DSA’s, and DST’s. The system could handle workflows for different loans products with several fintech integrations.

- A web-based credit underwriting workflow for different loan products and rule engine integrations with CRIF.

- Customer servicing and collection application.

- Leading Fintech providers were integrated through the sourcing, credit and disbursement journey.

- Customer creation with the QDE (Quick Data Entry) process along with DDE (Detail Document Entry) process for detailed credit decisions.

- Banking and Financial statement uploads and report analysis integration for accurate results.

- Capturing multiple collateral details along with Insurance and provision for uploads of Login and Checklist documents.

- Existing CAM files Digitization (Excel to System).

- Legal, Technical, FI and detail collateral reports for credit reviews and decision-making.

- Loan amount calculator basis eligibility criteria derived.

- Implementation with the rule engines for required validations and deviations in loans.

- Module for data preparation of disbursement post-credit reviewed stage.

Results:

The outcome of the solution included:

- A fully digitized solution for a robust and unique LOS and LMS in one application.

-

Existing CAM files Digitization (Excel to System).

-

Customized Solutions for ALL Loan Products in the market.

-

Custom Credit Decision-making System.

-

Multichannel and Omnichannel Sourcing Solution.

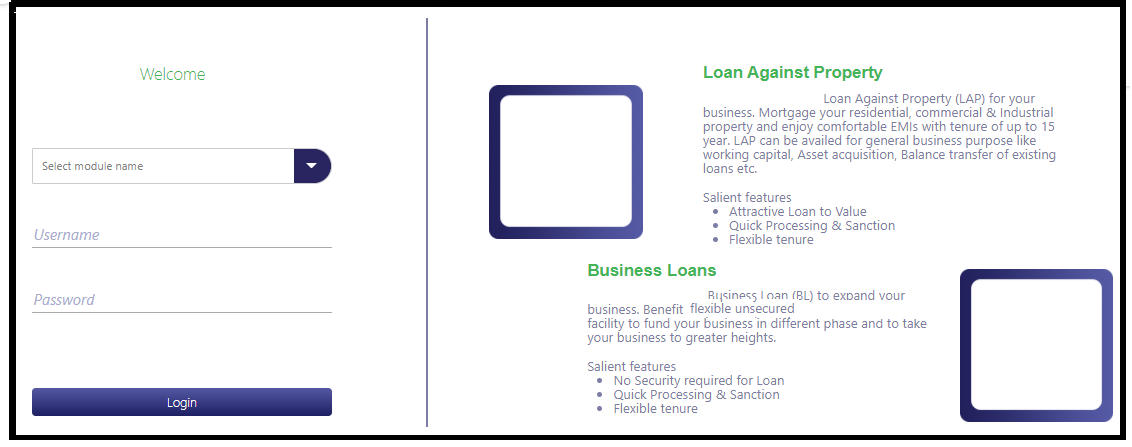

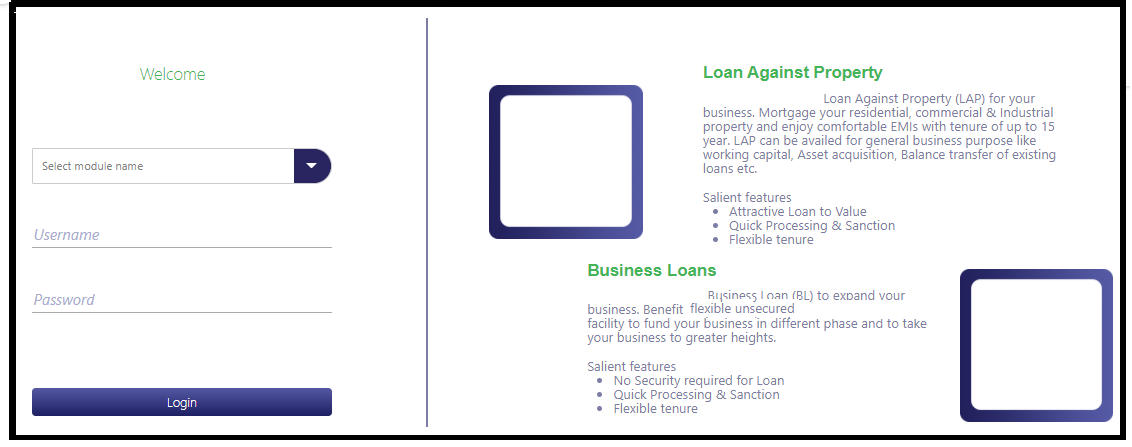

Login page:

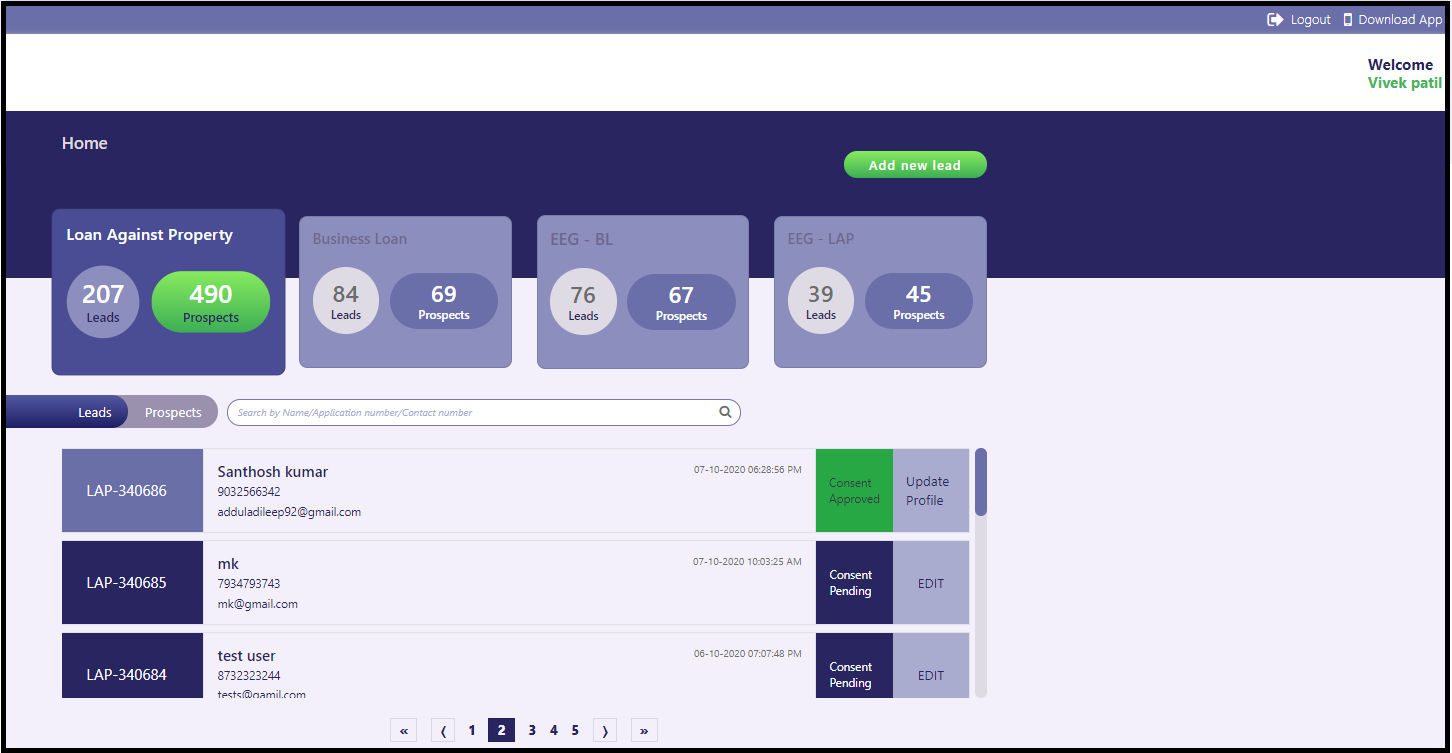

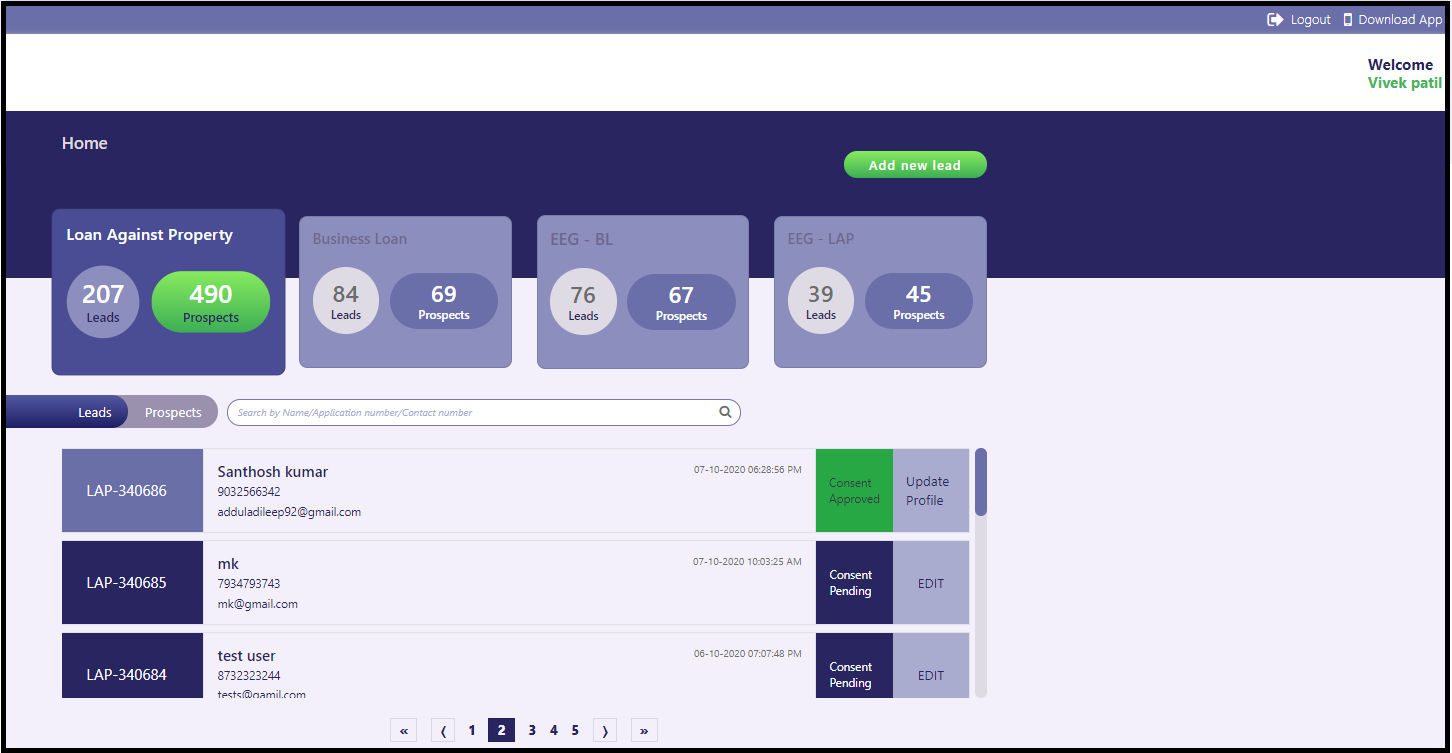

Landing Page Dashboard:

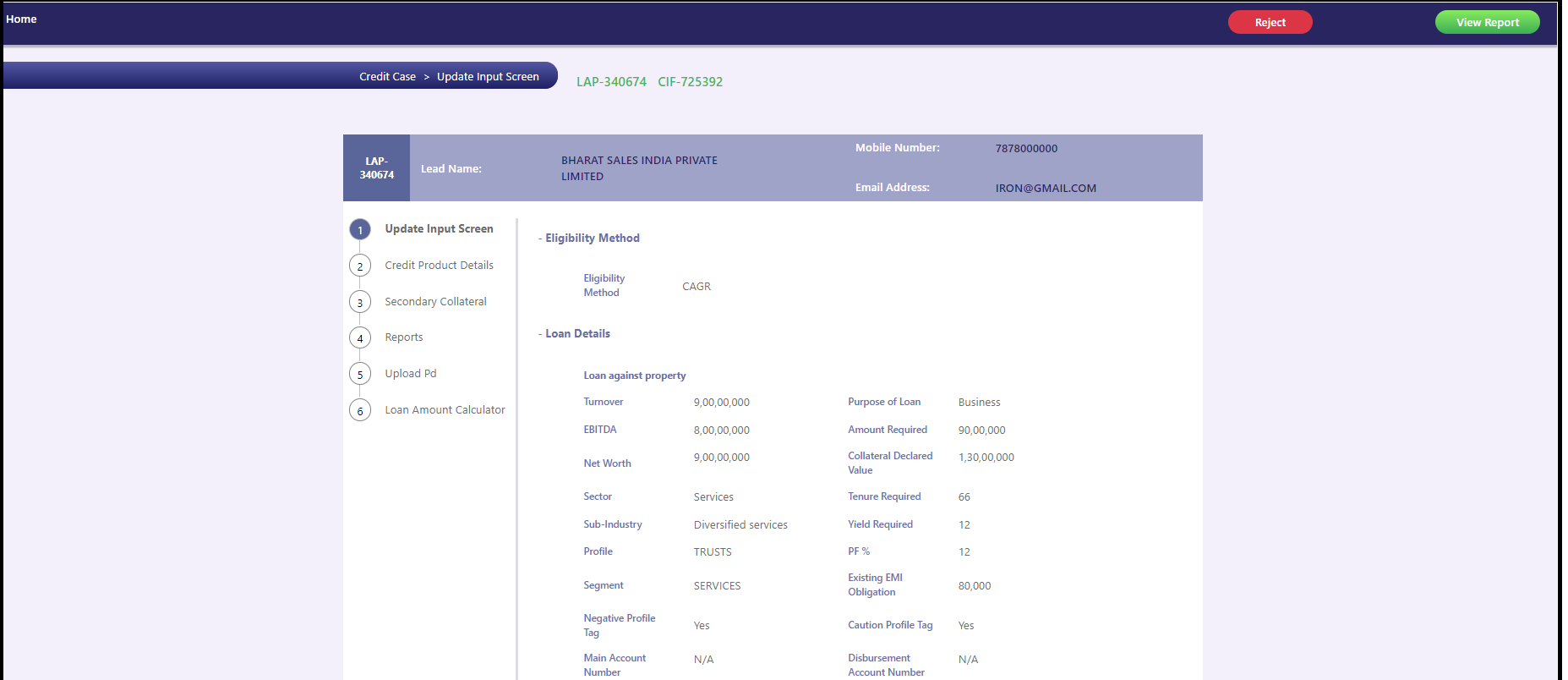

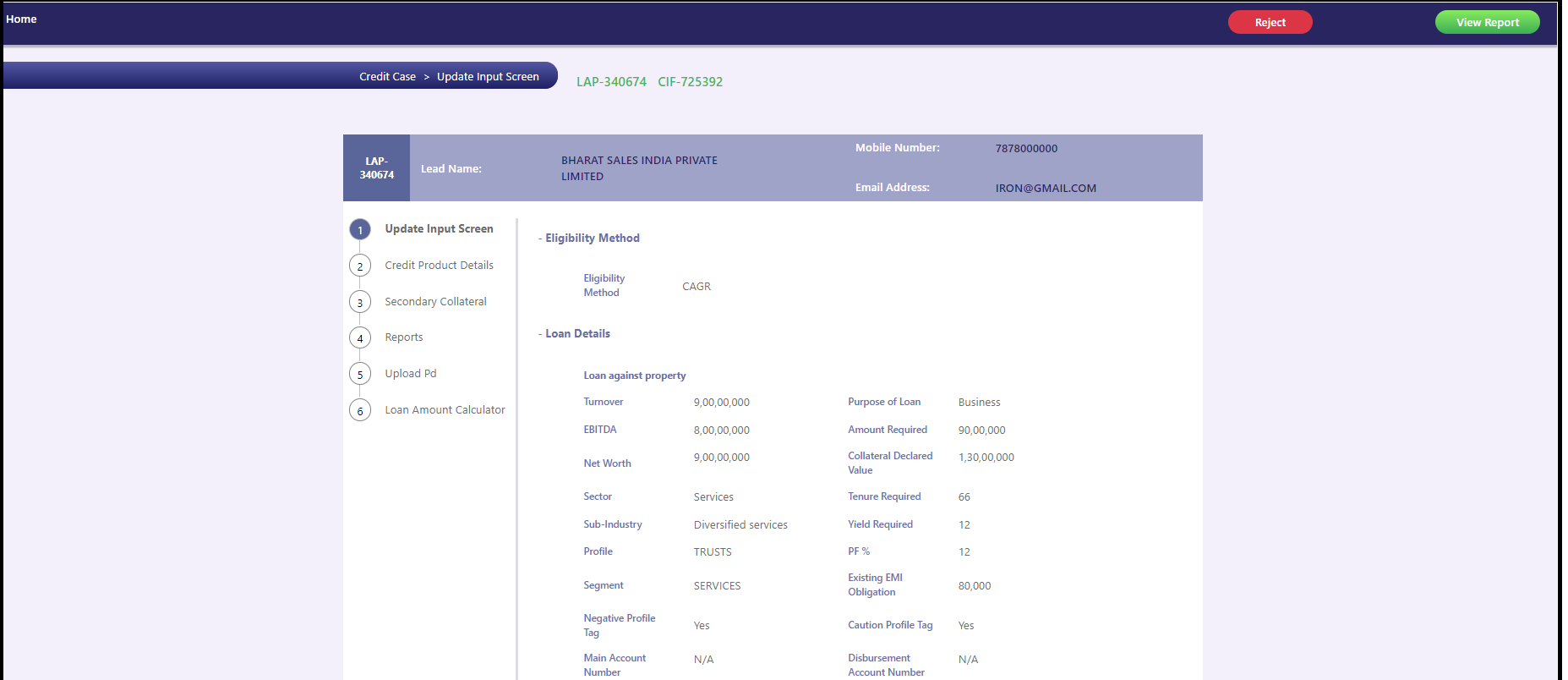

Credit Module:

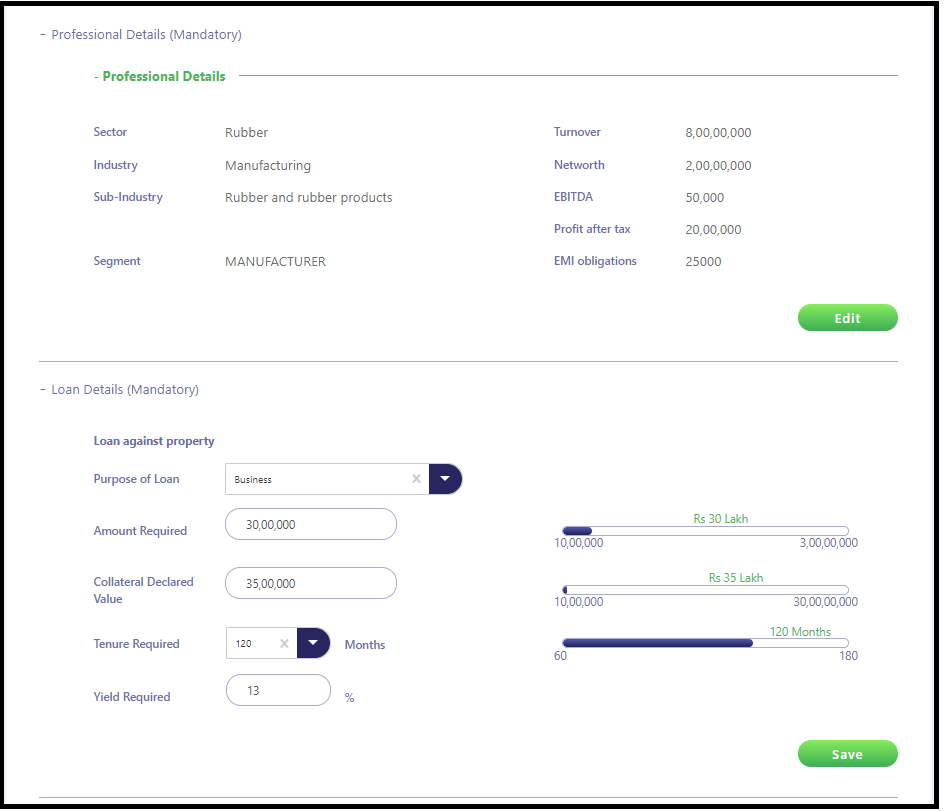

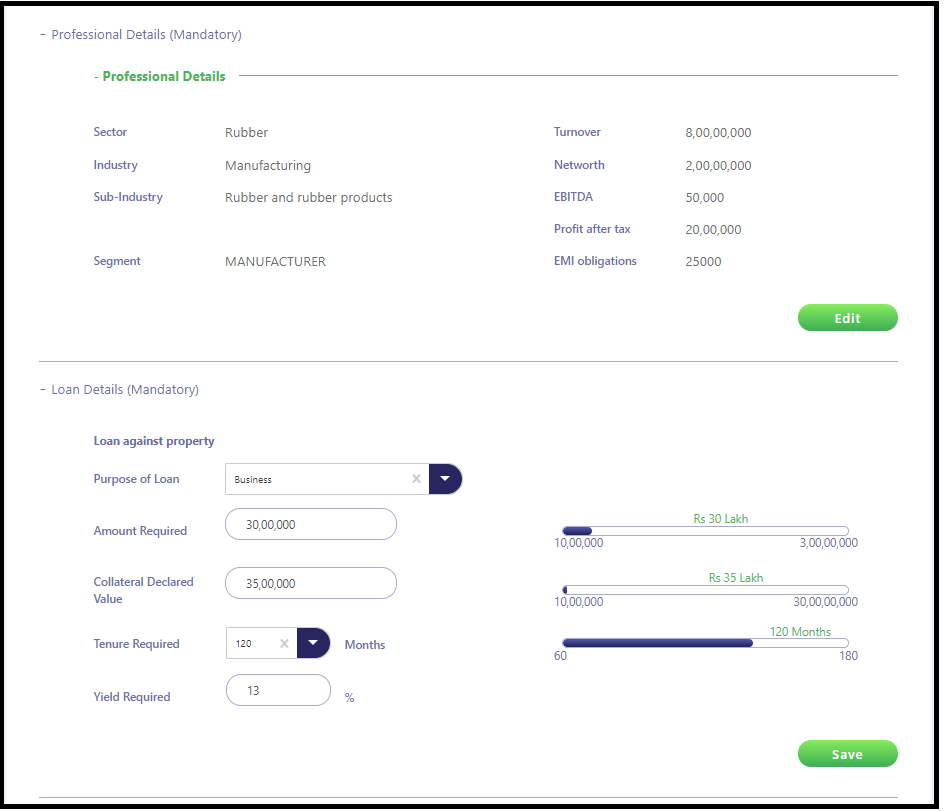

Loan Details Module:

Hire a React Native Developer for your project.

Just drop us an email. Our team will talk to you soon!

GrowthSource

Digital Loan Origination System (LOS)

GrowthSource is a leading digital-only NBFC was looking to build a platform to provide SMEs with secured and unsecured loans, loans against property, and personal and consumer durable loans.

Location – India

Backend – Java

Front End – ReactJS

Database – MS SQL 2016

Mobile App – React Native

Server – AWS

Executive Summary :

The primary purpose was with the Digital LOS was to design and execute a system to lend nimbler, standardized, streamlined and transparent loans to businesses and opening up new avenues for growth and profits. It was also required to manage the entire loan lifecycle from inquiry to data preparation for disbursement on a single, intelligent and highly advanced platform.

Challenges:

The primary hurdles included the following:

- Building a platform that can be used by sales, DSA’s, DST’s, etc.

Integrating fintech APIs for automated data population for seamless processing. - Building the credit underwriting module with rule engine integrations from CRIF.

- Creating a customer servicing and collection application.

- Developing a complete login management system to manage hierarchy within sales, credit, collection etc.

- Smooth and multi-threaded workflow from lead generation in sales to extensive credit decision-making phase and disbursement.

Solutions:

Focusing on the problem statement, the system was built using hybrid technology to make it available on both app and web. The entire application was leveraged microservices architecture to make it scale ready. The features that we developed included:

- A sourcing system that provides a similar user experience for all partners such as sales, DSA’s, and DST’s. The system could handle workflows for different loans products with several fintech integrations.

- A web-based credit underwriting workflow for different loan products and rule engine integrations with CRIF.

- Customer servicing and collection application.

- Leading Fintech providers were integrated through the sourcing, credit and disbursement journey.

- Customer creation with the QDE (Quick Data Entry) process along with DDE (Detail Document Entry) process for detailed credit decisions.

- Banking and Financial statement uploads and report analysis integration for accurate results.

- Capturing multiple collateral details along with Insurance and provision for uploads of Login and Checklist documents.

- Existing CAM files Digitization (Excel to System).

- Legal, Technical, FI and detail collateral reports for credit reviews and decision-making.

- Loan amount calculator basis eligibility criteria derived.

- Implementation with the rule engines for required validations and deviations in loans.

- Module for data preparation of disbursement post-credit reviewed stage.

Login page:

Landing Page Dashboard:

Credit Module:

Loan Details Module:

Results:

The outcome of the solution included:

- A fully digitized solution for a robust and unique LOS and LMS in one application.

-

Existing CAM files Digitization (Excel to System).

-

Customized Solutions for ALL Loan Products in the market.

-

Custom Credit Decision-making System.

-

Multichannel and Omnichannel Sourcing Solution.

Hire a React Native Developer for your project.

Just drop us an email. Our team will talk to you soon!

Hire Software Developers

Design Thinking

Hire Software Developer

Product Engineering

Company

Simple things should be simple, complex things should be Possible