SarvaGram Fincare Pvt. Ltd.

Multiple modules for a Rural Finance NBFC

SarvaGram Fincare Pvt. Ltd. is a rural fintech organization that aims to upgrade the livelihood for aspiring households based in Rural and Semi-urban India. Its primary intervention includes offering relevant credit products that enhance the capacity and income generation opportunities for households. The organization follows a high touch – high tech business model that leverages physical and digital interaction with the clients.

Location – India

Technologies Used:

Backend – JAVA

Frontend – ReactJS

Database – MySQL 5.7

Mobile – Android PWA App

Executive Summary :

The primary purpose was with the Digital LOS was to design and execute a system to lend nimbler, standardized, streamlined and transparent loans to businesses and opening up new

avenues for growth and profits. It was also required to manage the entire loan lifecycle from inquiry to data preparation for disbursement on a single, intelligent and highly advanced platform.

Challenges:

The primary hurdles included building the following features:

- Lending Services – Credit underwriting and related workflow as against the manually managed records on excel and emails which is error-prone.

- Non-Lending Services – Farm machinery and consumer durable management were maintained outside the system leading to customer duplication. No concept of customer ID present at the time.

- Non-Lending Financial Services – Mutual Fund booking.

- Customer servicing – No existing communication touchpoints with the customer.

- Data points necessary to promote and launch new products and services basis collection history and other parameters.

Solutions:

The following modules/solutions were developed for the client:

● Credit Underwriting Module:

○ CAM to handle decision-making

○ Manage deviations and escalation workflows

○ Flexible Rule Engine for credit managing rules and executing them

○ Integration with LOS for case sanctioning

● Unified platform for managing multiple services:

○ Lending – Lead capturing post which the lead was pushed to LOS.

○ Non-Lending Financial Services – Mutual Funds, Insurance aggregators integrated.

○ Non-Lending Services:

■ Farm Machinery Leasing workflow

■ Consumer Durables workflow with and without consumer durable loan ○ Lead and Customer Management – All leads and customers were created on the platform which would handle dedupe etc.

○ Inventory Management Module – For product configuration and managing the inventory of both farm machinery and consumer durables.

● Data Warehouse:

○ Encapsulation of all data points in the client’s ecosystem mainly for analytics, scheme and product creation.

○ One-stop solution for all analytics and reporting requirements.

● Customer Self Service Application – PWA application built for customer servicing and providing platform features.

Results:

The outcome of the solution included:

- Simplified operating environment and improved productivity and efficiency.

- One unified platform to access all services.

- Detailed user and access management.

- Defining schemes and products for good/paying customers. All reporting requirements are handled using DWH.

- Easy Inventory management for client and its franchises.

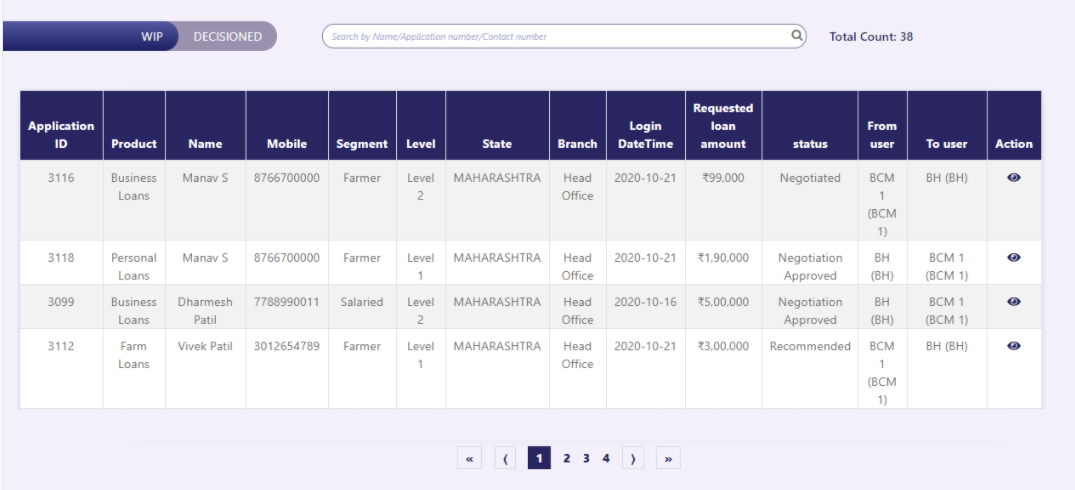

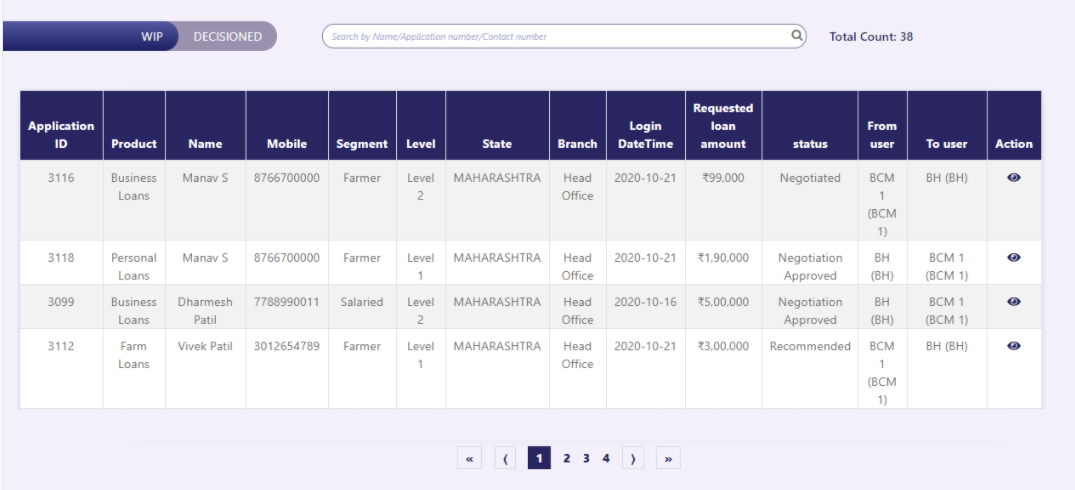

Case Listing:

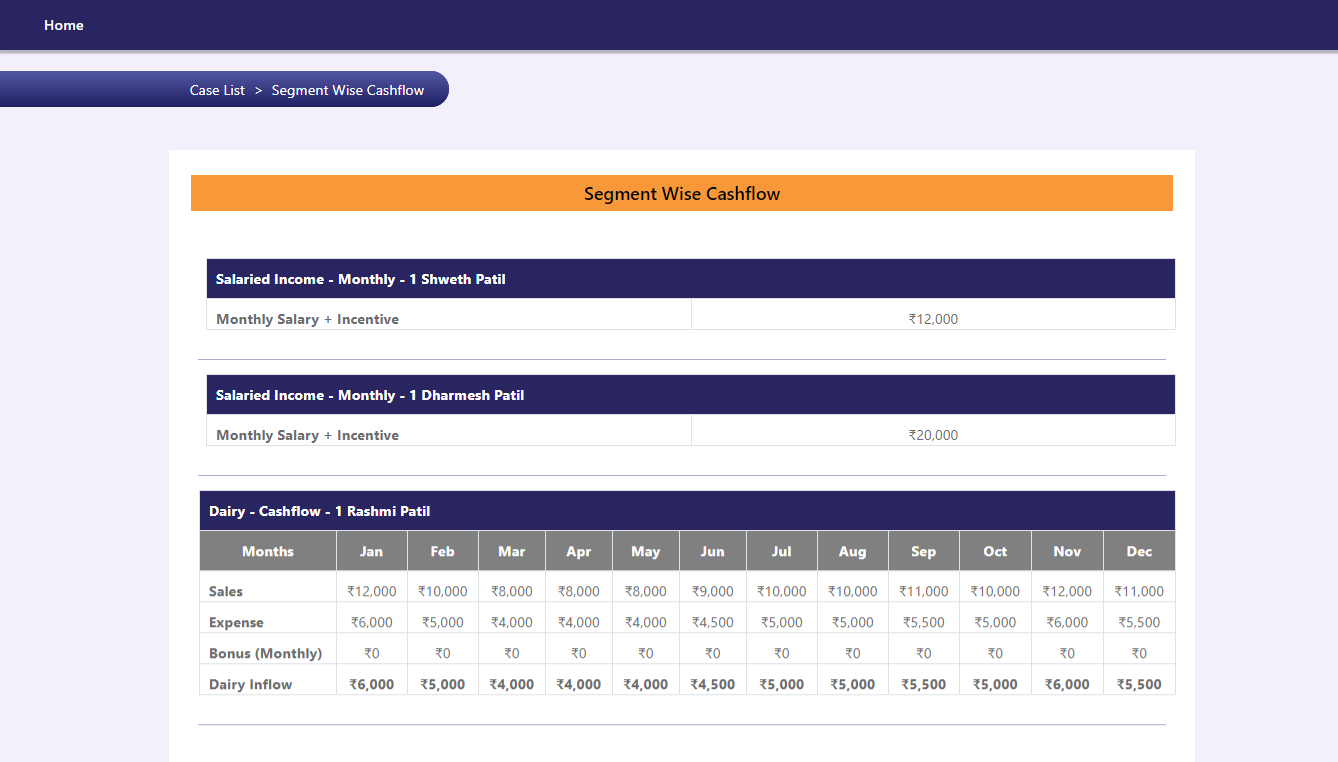

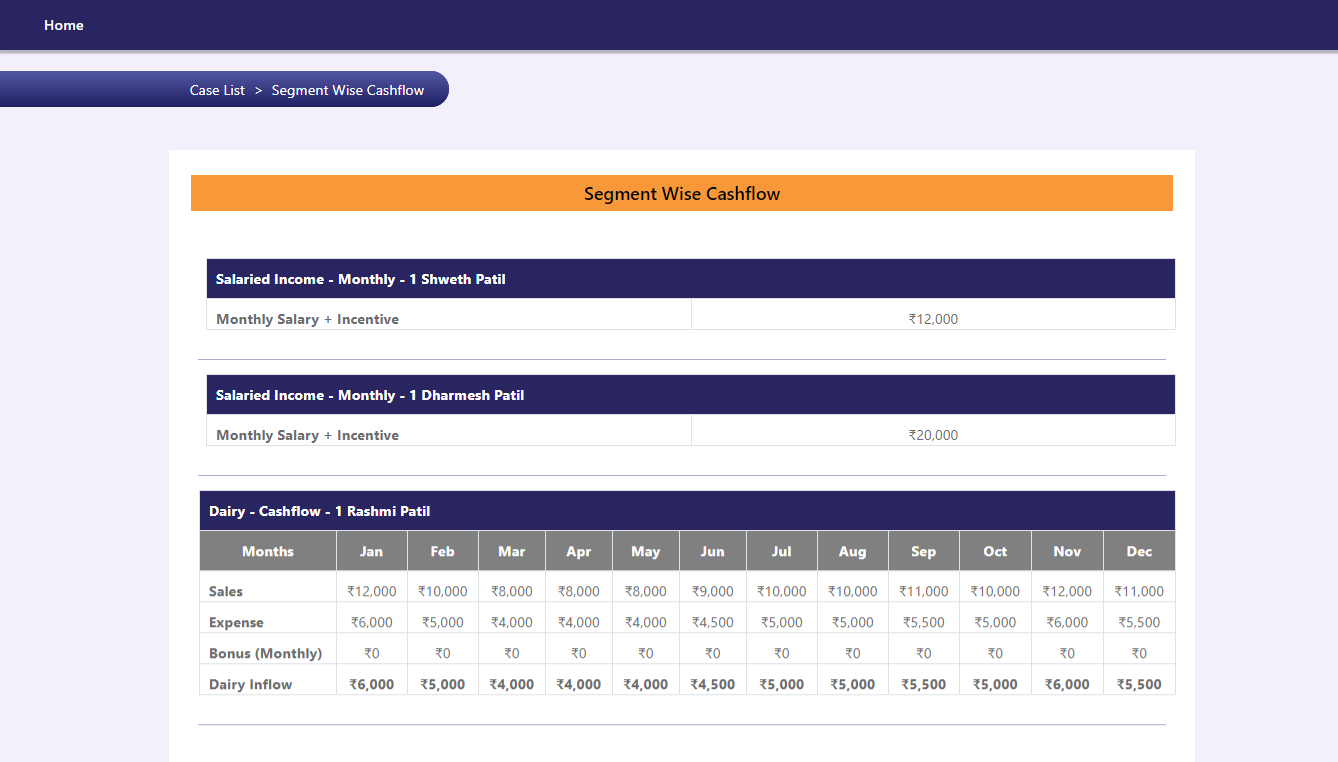

Segment-wise Cashflow

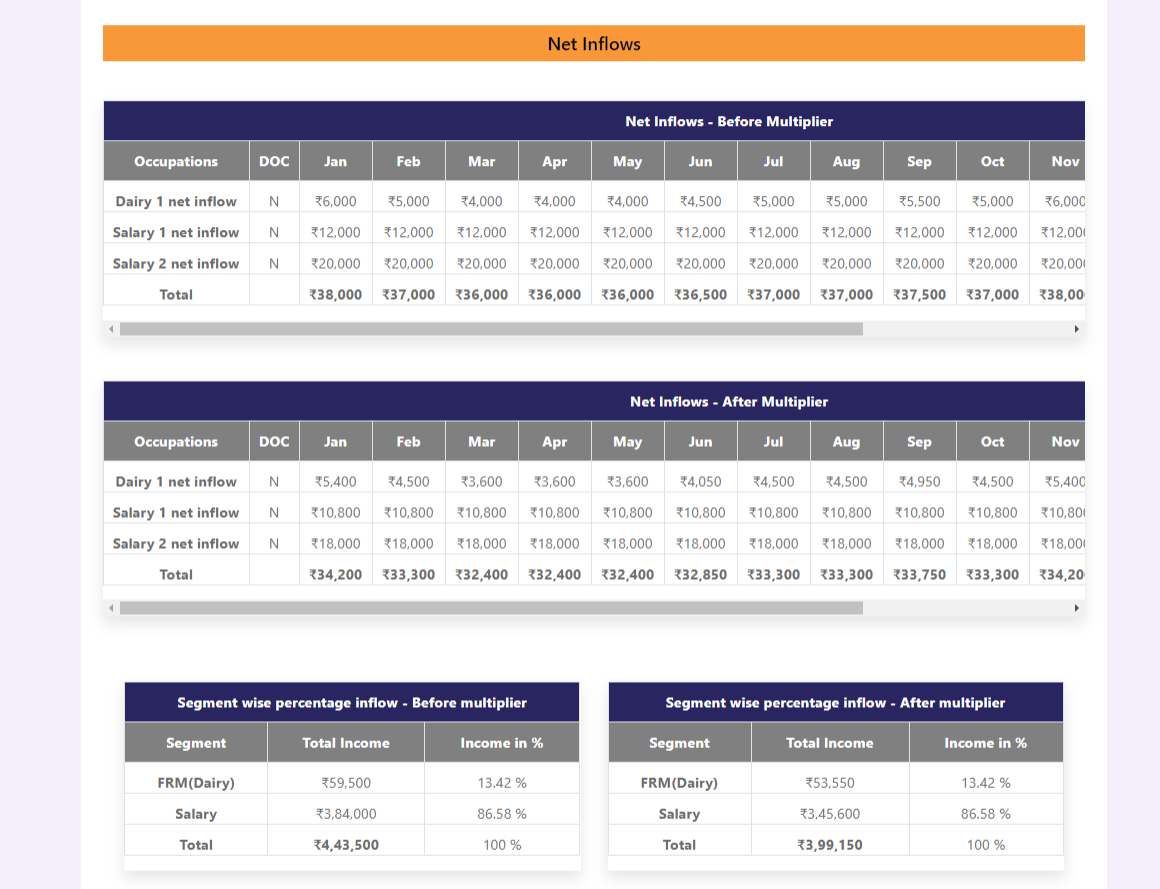

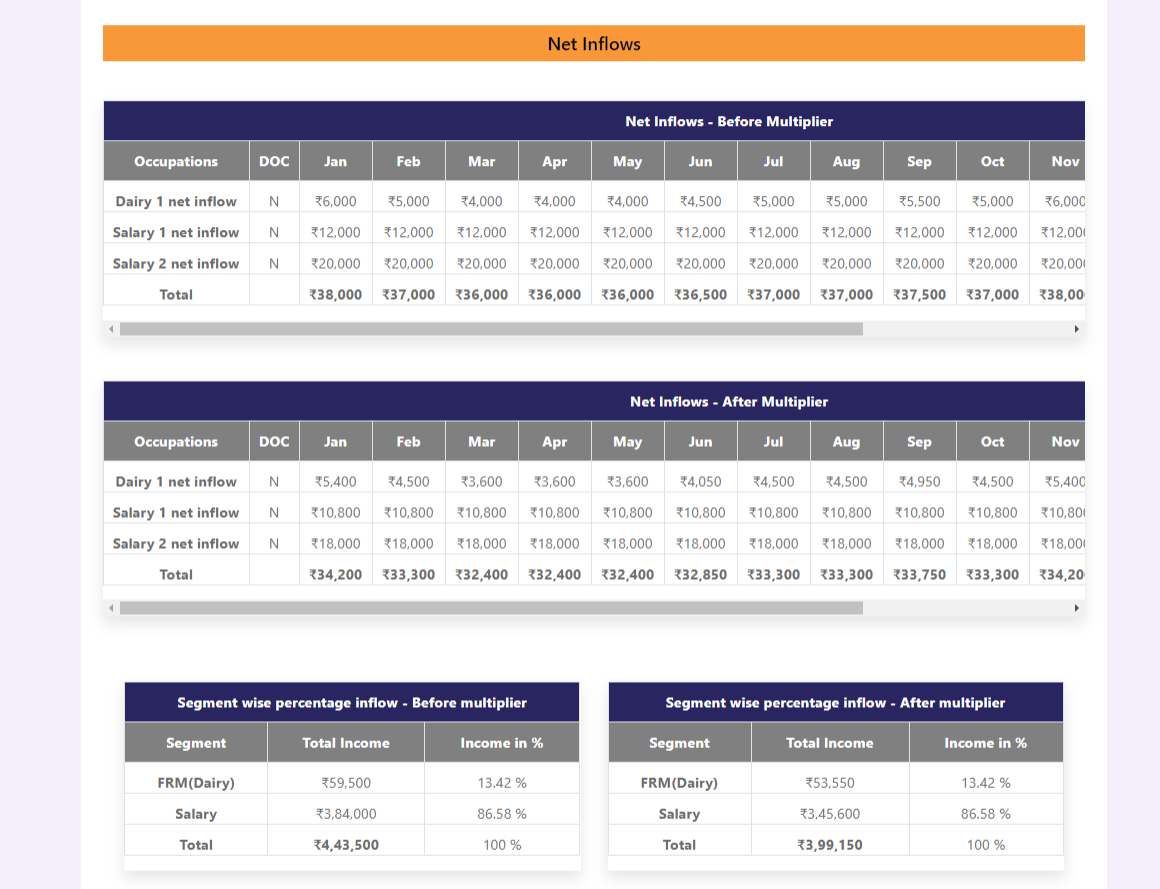

Net Inflows:

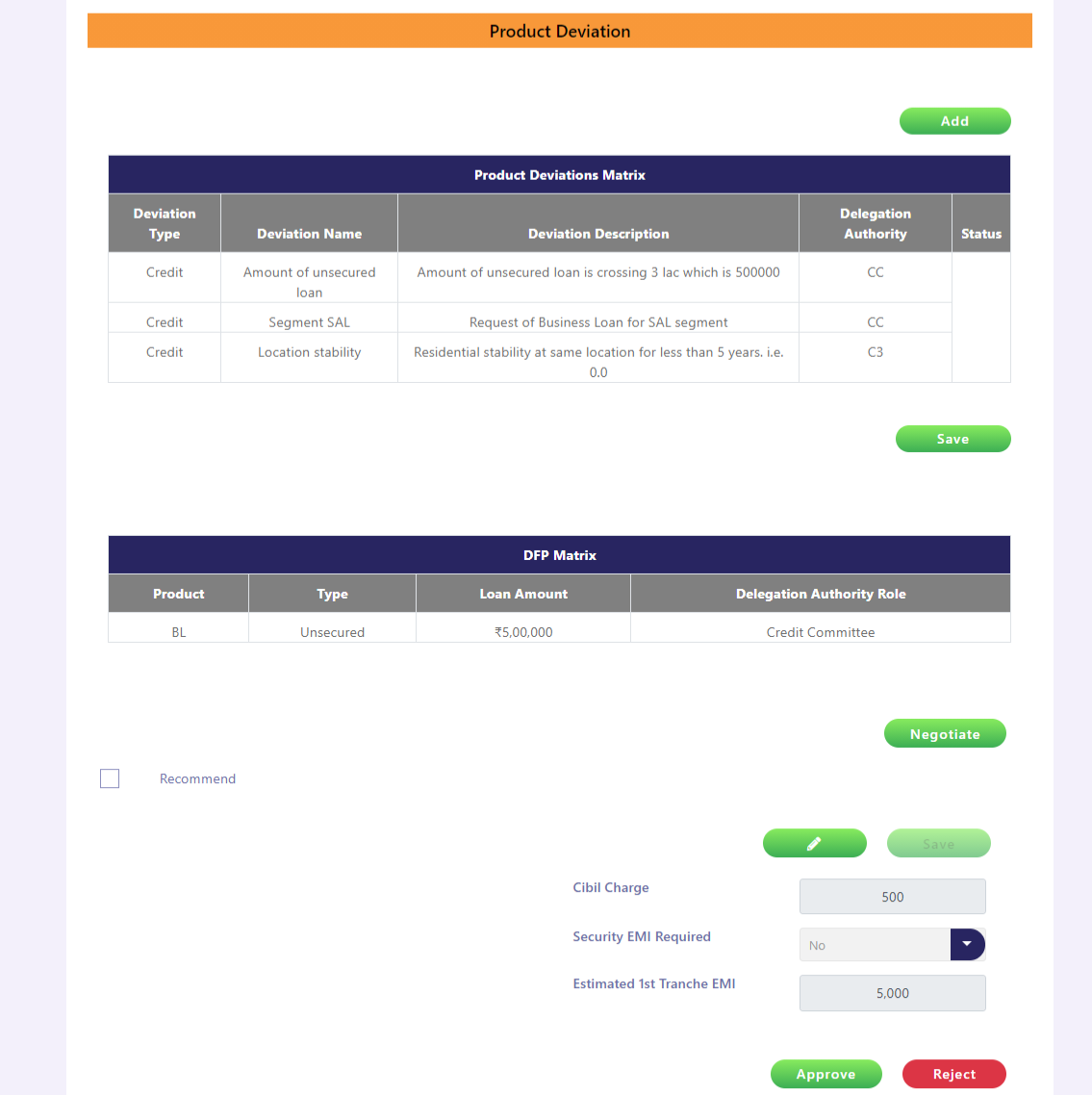

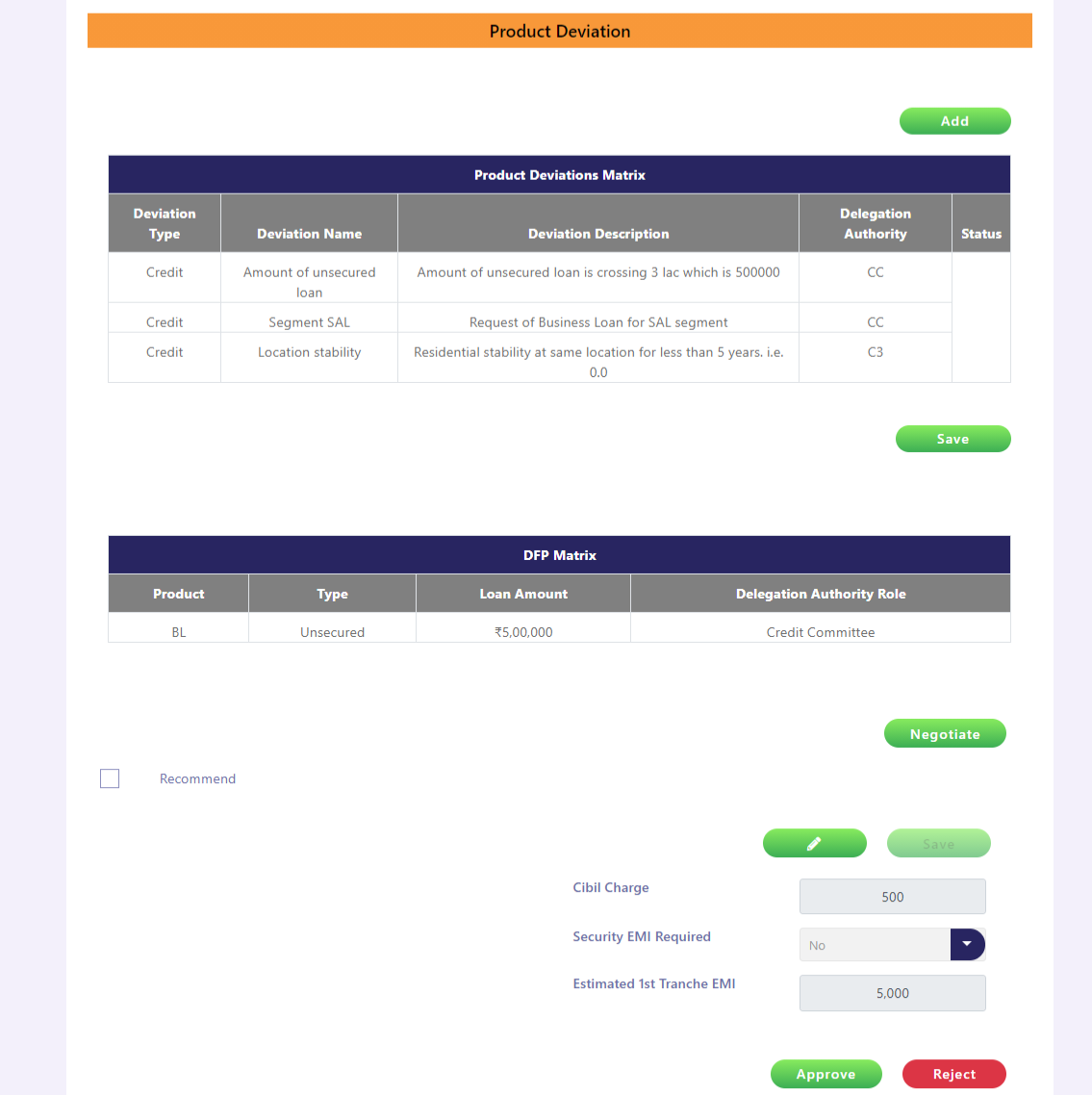

Product Deviation:

Hire a Java Developer for your project.

Just drop us an email. Our team will talk to you soon!

SarvaGram Fincare Pvt. Ltd.

Multiple modules for a Rural Finance NBFC

SarvaGram Fincare Pvt. Ltd. is a rural fintech organization that aims to upgrade the livelihood for aspiring households based in Rural and Semi-urban India. Its primary intervention includes offering relevant credit products that enhance the capacity and income generation opportunities for households. The organization follows a high touch – high tech business model that leverages physical and digital interaction with the clients.

Location – India

Technologies Used:

Backend – JAVA

Frontend – ReactJS

Database – MySQL 5.7

Mobile – Android PWA App

Executive Summary :

The primary purpose was with the Digital LOS was to design and execute a system to lend nimbler, standardized, streamlined and transparent loans to businesses and opening up new

avenues for growth and profits. It was also required to manage the entire loan lifecycle from inquiry to data preparation for disbursement on a single, intelligent and highly advanced platform.

Challenges:

The primary hurdles included building the following features:

- Lending Services – Credit underwriting and related workflow as against the manually managed records on excel and emails which is error-prone.

- Non-Lending Services – Farm machinery and consumer durable management were maintained outside the system leading to customer duplication. No concept of customer ID present at the time.

- Non-Lending Financial Services – Mutual Fund booking.

- Customer servicing – No existing communication touchpoints with the customer.

- Data points necessary to promote and launch new products and services basis collection history and other parameters.

Solutions:

The following modules/solutions were developed for the client:

● Credit Underwriting Module:

○ CAM to handle decision-making

○ Manage deviations and escalation workflows

○ Flexible Rule Engine for credit managing rules and executing them

○ Integration with LOS for case sanctioning

● Unified platform for managing multiple services:

○ Lending – Lead capturing post which the lead was pushed to LOS.

○ Non-Lending Financial Services – Mutual Funds, Insurance aggregators integrated.

○ Non-Lending Services:

■ Farm Machinery Leasing workflow

■ Consumer Durables workflow with and without consumer durable loan ○ Lead and Customer Management – All leads and customers were created on the platform which would handle dedupe etc.

○ Inventory Management Module – For product configuration and managing the inventory of both farm machinery and consumer durables.

● Data Warehouse:

○ Encapsulation of all data points in the client’s ecosystem mainly for analytics, scheme and product creation.

○ One-stop solution for all analytics and reporting requirements.

● Customer Self Service Application – PWA application built for customer servicing and providing platform features.

Segment-wise Cashflow

Case Listing:

Net Inflows:

Product Deviation:

Results:

The outcome of the solution included:

- Simplified operating environment and improved productivity and efficiency.

- One unified platform to access all services.

- Detailed user and access management.

- Defining schemes and products for good/paying customers. All reporting requirements are handled using DWH.

- Easy Inventory management for client and its franchises.

Hire a Java Developer for your project.

Just drop us an email. Our team will talk to you soon!

Hire Software Developers

Design Thinking

Hire Software Developer

Product Engineering

Company

Simple things should be simple, complex things should be Possible