The future of digital lending with AFX: Digital Origination System (DOS)

Till now, traditionally the banks or NBFC’s were using the manual pen & paper process, which is not enough to address the evolving SME’s needs. So then comes the Loan origination system, which lack in the customer experience & User Interface. The LOS fails to provide that premium experience to the customer, which banks or NBFC’s can’t afford to let go.

AFX DOS is solution to one of our client, which is an NBFC who was looking to build a platform to provide SMEs with secured and unsecured loans, loans against property, and personal and consumer durable loans.

The challenges that NBFC was facing,

- Client drop out in early stage

- Lack of customization according to requirement in lending service

- Higher turnaround time

- Ineffective data monitoring & management

- High operation cost & resource consuming

- Less accuracy with the manual process

- Manual management of regulatory & compliances policies.

- Time consuming in cross checking each document & merging data from different sources

- Low Customer satisfaction

How banks/ NBFC’s can scale up their lending with our Digital Origination System (DOS)

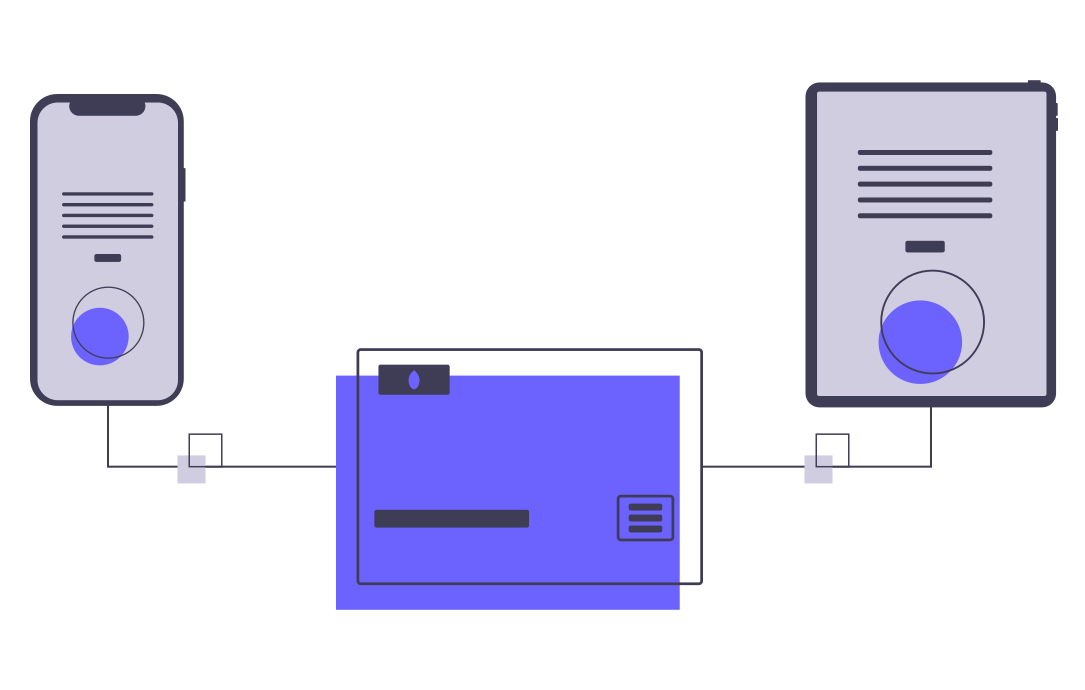

Focusing on the problem statement, the system was built using hybrid technology to make it available on both app and web.

We digitized it, made the UI easy, simple to understand, & designed in such way that customer can take self-journey, or can take assisted journey & apply for loan. Which reduced the early stage customer drop out.

Our Digital on boarding process helped to capture all the required documents online, form which fast-forwards the overall process of lending. Made quick & easy for lending entity to acquire & on-boarding

AFX DOS, is built with all the additional integration, required for any lending process. It provides seamless borrower experience, as a single platform with multiple-integration. Which reduces the complexity & cost associated with managing multiple systems, throughout the process. This system saved 14% of cost & 22% time saving.

By implementing AFX Digital origination system (DOS), accuracy increased by 75%. Even validation documents of a borrower can be scanned digitally, making the process a whole lot quicker and less cumbersome than it traditionally is. Which resulted in 22% faster turnaround.

AFX DOS optimized & escalated loan underwriting procedure, Cloud integration improved security by 60% & makes it possible for the system to sync in data from credit bureaus, alternative credit scoring data, valuations and risk services.

By implementing AFX DOS, enabled our client to give premium customer experience. As they were able to give quick loan approval, quick closing & quick delivery. Our client able to achieve 58% lift in customer satisfaction.