Indian SMEs and MSMEs are the backbone of the economy. Contributing to GDP, exports, and employment, they play an important role in the economy. Until the last few years, however, financial institutions underserved SMEs, which hampered their growth. But nowadays the Digital Lending The Game-Changer For SME Financing. The lack of ease in the transaction was one of the prime difficulties faced by SMEs until the last decade. But now the scenario has changed. For rural and urban SMEs, banking has become much easier and faster. The Indian government’s great support for SMEs is helping to bridge the gap and create a whole new image for SMEs. The Indian government prefers electronic payments over hard cash.

Several government-funded loan schemes operate only through online transactions. To upgrade cash transactions to online transactions, the government runs schemes like CGTMSE, MUDRA, and Stand Up India.

These credit cards transfer the loan amount directly to the beneficiary’s bank account, which indirectly encourages online shopping. In 2017, the government will launch TReDS to strengthen the online transaction system. It is an electronic platform for MSMEs. MSMEs can use this platform to trade receivables and discount bills with large corporations.

Digital lending is expanding its horizons. With digital lending, SMEs were able to solve many of the financing problems they were facing. Adoption of the digital transformation to automate the lending process reduced the time & effort in all the operational processes of lending & lending decisions. And step forward, the inclusion of AI in the lending decision process reduces the fraud risks. Digital transformation technologies are taking digital lending to the next level.

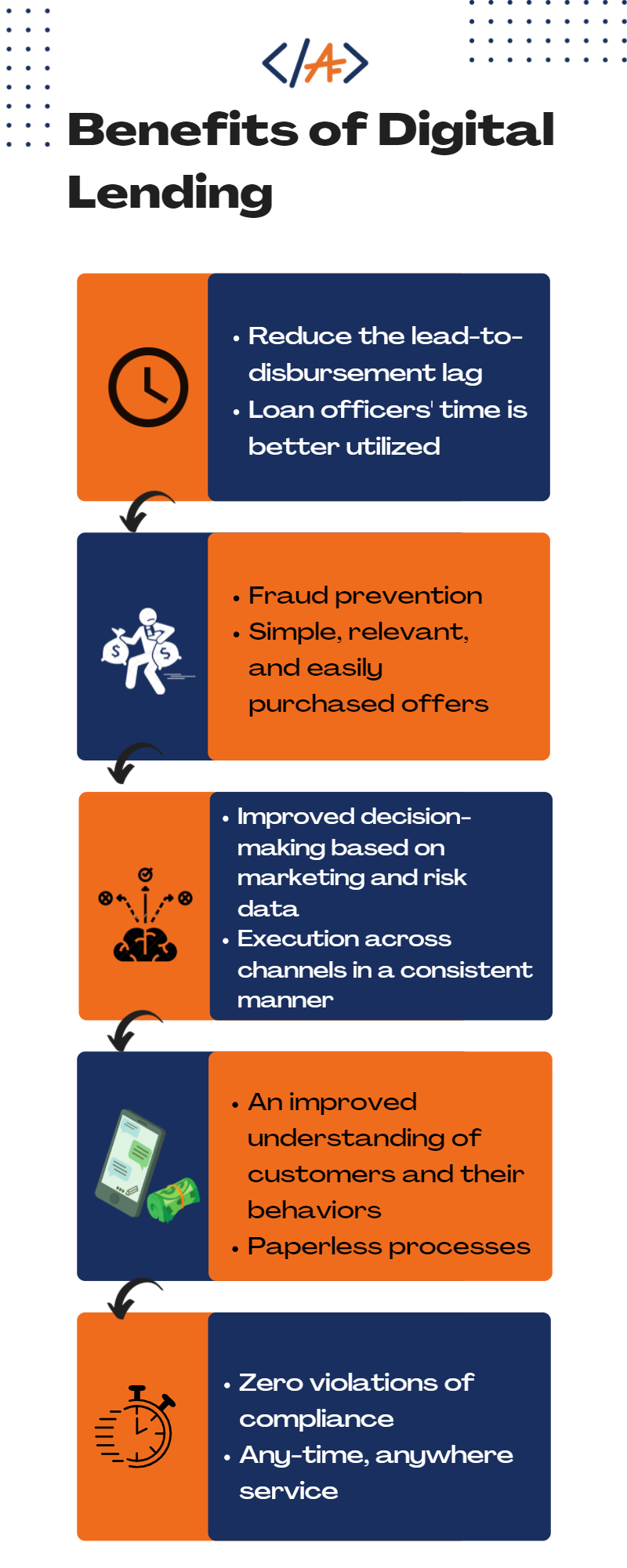

Lenders can benefit greatly from digitization in multiple ways:

- Reducing the lead-to-disbursement lag

- Loan officers’ time is better utilized

- Fraud prevention

- Simple, relevant, and easily purchased offers

- Improved decision-making based on marketing and risk data

- Execution across channels in a consistent manner

- An improved understanding of customers and their behaviors

- Paperless processes

- Zero violations of compliance

- Any-time, anywhere service

Digital lending is completely paperless, working through electronic means. Enabling the lenders with SMEs to focus on their benefits & scaling up their business to the next level.

The emergence of digital lending has heightened the customer experience and improved customer journeys from lead to disbursement. It has brought great scope for optimizing payments, cross-selling & revenue increasing. It cut downtime & cost on human resources that are involved in this entire loan process from lead to disbursement.

All this is possible by transforming the lending process with a loan origination system, a fintech software. A platform for digital lending. These digital lenders have been able to provide loans to SMEs at competitive rates due to the savings they have achieved by utilizing fintech to conduct their loan origination processes, thereby providing SMEs with multiple options to choose from. Transparency in the whole loan process is facilitated by a single dashboard technology that tracks the loan application.

At AnalyticsFox Softwares, our fintech solution AFX-DOS is a DIgital first-loan origination system. Due to its microservice architecture, it is scalable and easily extensible. In addition to its rule engine, it has an API gateway that allows you to use all the fintech integrations available on the market right out of the box. Customer-friendly UI makes it easy for Sales, DSAs, and customers to adapt to both the web and mobile

Contact us today to learn more about the Digital Lending process and its applications. Reach out to, sales@analyticsfoxsoftwares.com